Diagnosis in a Time of Uncertainty

Building your External Diagnosis Map

A client of ours, we’ll call him Peter, who is CEO of a medical software scaling company, recently came to see us at his wits end: “We’ve enjoyed a stellar run of 30% year-on-year growth, but we’re now facing a speed bump or even worse. Each week seems to send a new challenge my way. I’m having real difficulty in getting the team to step up – it seems harder than ever to make decisions and align around a clear roadmap.”

What was really confusing Peter is that his team is the same excellent team that propelled growth year-on-year, and their product, consistently tweaked and upgraded, remains a market leader. “If I had glaring staffing issues or an amazing competitor had come along with a superior product, then I’d have clarity, at least. But that’s not the case. I can’t work it out. I feel our team is an echo chamber of conversations going nowhere. We have stalled!”

Diagnosing the Growth Gap

We invited Peter and his team to participate in a workshop to identify and overcome what we call the ‘growth gap’ which we define as the shortfall between a team’s current performance and its ambition/potential.

Bridging the gap starts with diagnosis to identify what’s causing it. Diagnosis is almost always challenging for a team. Initially at least, it generally results in a jumble of conflicting symptoms and causes because each member of the team is coming from a different place - sales blames the product, the product designers blame customer service, the CEO blames performance, the COO is concerned about over-spending. But by working through targeted processes, we get to the root causes and that’s always a eureka moment for the team. They can now focus resources and attention where they are needed.

As expected, the first few sessions with Peter and his team threw up plenty of symptoms and secondary causes, however unusually the root causes didn’t emerge. Sometimes there is resistance to the process - if, for instance, the root cause is the CEO’s leadership style, then that always takes time to emerge because it’s hard to be objective about your own leadership. This wasn’t the issue here; Peter and his team were very open and committed to the process. And yet, despite digging into all the internal company behaviours - sales, product, leadership and performance - we weren’t getting to root cause.

It was only when we turned to the external environment that we got our eureka moment. The company had serious supply-chain issues: they had had to move from Chinese suppliers of certain sub-components to Western suppliers and that was causing disruption and greater expense. The disruption was delaying sales and increasing friction within the team. New government regulations were slowing down customer demand - add to this, rising inflation and interest rates which were spooking the CFO and the Board. No wonder Peter was experiencing those ‘speed bumps’. He was facing serious headwinds. Like most CEOs, he had looked to the team to find a solution - why wasn’t it ‘stepping up’, ‘taking decisions’ and ‘aligning around a roadmap’?

We agreed that the solution lay within the team but the team had no hope of fixing anything until they did an in-depth diagnosis of the external factors impacting growth. They needed to build up a comprehensive view of the whole external environment, not just siloed individual problems.

Volatility is the New Normal

In 2020 we published The Growth Roadmap®, a book for growing companies which distils our learning around ‘the growth gap’ into five steps which are incremental and sequenced. Each step is contingent on the last. It all starts with Diagnosis as a first step, to identify what is causing the gap.

Our research for the book included not just our workshops with clients over the years, but a diagnostic questionnaire which 500 leadership teams completed. What emerged from the workshops and focus group was a predominance of internal issues around customer needs, sales, leadership, communication and performance. External issues around market fluctuation and supply chains were also identified but these were fewer and less pressing.

With hindsight that focus on internal issues isn’t a surprise. The period 2013-2020 when we were researching and writing the book was a time of market stability. Inflation was low. Interest rates and supply chains were steady. There was some volatility in 2016, the year of Brexit and Trump, but it soon stabilised. In our workshops and diagnostic questionnaire, external factors didn’t emerge as critical to the growth gap.

We finished The Growth Roadmap® at the beginning of 2020 and published in September. Between completion and publication, the world went into lockdown and nothing has been the same since. In three short years, it has been one crisis after another; more lockdowns, war in Ukraine, sanctions on Russia, energy shortages, supply chain disruption, ever increasing climate emergencies including heat waves and flooding, retreat from engagement with China, a mass move away from office towards home working, rising inflation and interest rates, exacerbated by global political instability and poor decisions by governments.

No wonder Peter and many others are experiencing headwinds! It took him - and to be honest, ourselves - that bit longer to get to root cause because this kind of pressure from external forces is unprecedented within our lifetimes. Of course, we’ve seen sporadic market fluctuation over the decades, but nothing like this, where volatility is the new normal and the inevitability of rapid change across multiple horizons is the only thing we can take for granted.

How can companies best approach this disturbing new normal? In the old world order, when the root cause of the growth gap was internal, that might have been challenging to fix but it was also empowering because these are issues your company has direct control over and can take action to improve. When the issue is supply chain disruption at the other side of the world or rising inflation then that seems like something well beyond any company’s remit.

So what to do? Should we abandon all orthodoxy and go for wild and radical solutions? Well that’s what Liz Truss and Kwasi Kwarteng came up with and it didn’t work out too well for them! From our vantage point of advising companies in this time of uncertainty, what we’ve discovered is that, counterintuitively perhaps, conducting rigorous diagnosis and sticking to the roadmap is more important now than in times of stability.

When markets and supply chains and political systems are stable, there’s leeway to take risks and experiment. But during volatility, the safety net is gone - a few mistakes and you face wipe-out. This is a time to be thorough and cautious, to adopt a structured empirical approach to diagnosis and strategy. Good leaders ask questions like, What is happening? Why? What might happen in the future? What might we do about it?

Jack Welch, legendary CEO of General Electric, once said “When the rate of change on the outside exceeds the rate of change on the inside, the end is near.” Scary words for the times we are in now! But what if you were able to assess the rate of change outside, and then apply your understanding to adjust the inside to navigate the outside? Flying blind in turbulent conditions is a nightmare scenario, obviously, but if you’re able to measure the turbulence and anticipate future disruptions, you can plot a flight path and complete your journey.

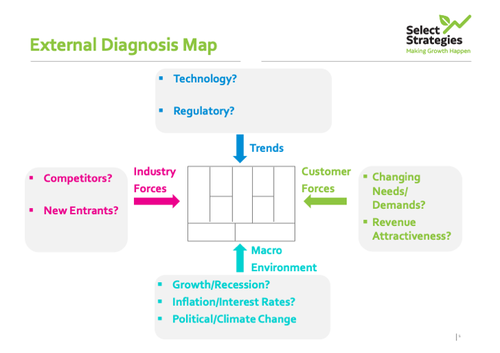

Building a Visual ‘External Diagnosis Map’

How can companies measure turbulence? It starts with building an External Diagnosis Map to visualise the external impacts on your business. The best approach at the start is to get everything down - any and all of the possible external factors that might be impacting growth. Encourage the team to remove their filters and just fire off ideas, suggestions and questions in all directions. This is a time for data-gathering and open dialogue, not for over-thinking.

Questions to consider include:

- Opportunity - Where is the largest new opportunity? Which geography or region is most promising?

- Global move away from office-working - What is the impact of your customers having distributed workforces? How is this affecting their processes?

- Pandemic after-effects - How is the mental wellbeing of staff, suppliers and customers?

- Technology - How might artificial intelligence, machine learning, cyber security or GDPR affect your business? What might be the impact of software moving to public cloud, on a pay as you go basis?

- Business Models - What new business models are emerging in your industry? Which ones look most promising?

- ‘Expectation Transfers’ - An expectation transfer is when people get something in one setting (or believe they can) and expect it to translate to all settings e.g. when people order an item on Amazon in a few clicks and it arrives the next day, they might demand same with your product. What ‘expectation transfers’ are impacting your business?

- Government and Regulatory Bodies - What role will these play in accelerating or slowing down innovation?

- Climate Change - How are new attitudes and measures to protect against climate change affecting your industry?

- China - Are you or your suppliers having to disengage from China? How is this affecting sub supply costs and customer service?

- War in Ukraine and Sanctions on Russia - Have these slowed up decision-making in your European markets? How are you handling the uncertainty of outcome?

- Energy Shortages - How is this affecting costs and product development?

- Supply Chain Disruption - Do you understand the location of your key suppliers and the key risks those suppliers and you face?

- Inflation and Interest Rates - How are these affecting your costs and employee remuneration?

- Recession and Slowdown - How will this affect customer buying cycles? Will more stakeholders be involved in customer buying decisions?

- Political Instability and Weak Political Leadership - Is this affecting you directly in your company headquarters? Is it affecting the markets you sell into?

Applying the Map: from External Trends to Internal Processes

Your map should be starting to take shape - with lots of Q&As lighting up some areas and fewer in others. You can now start ‘colouring in’: seek out the data and metrics that back up the senior team’s insights (NB always trust insight but always test it with empirical data!)

Now start applying the external to the internal: how are these global trends affecting the company areas: sales, customers, product, leadership, performance? Ask questions like:

- Customers: What new segments are emerging? Which customers are moving from off-shoring to near-shoring, because of political nationalism? What new jobs are customers looking to get done?

- Competitors: What strategies are your key competitors adopting to adjust to global trends? How is their performance? What new entrants are coming into the market?

- Product: Does your product need to be adjusted for the public cloud? Do you need to invest more R&D into machine-learning and AI?

- Leadership: Does the team have the knowledge and time to research into global trends and horizon-scanning? Do you need new capabilities - e.g. someone dedicated to understanding the regulatory environment? Do the CEO and CFO have the right mindset for volatility?

Articulate the Growth Gap: Create a Narrative

If you can see the growth gaps on the map, and you can articulate them in clear language, you are well on your way to resolving them. The next step is to analyse the map and articulate the key global trends and how they are affecting your business. Create a narrative and make sure that the whole team can articulate it.

In Peter’s case, he and his team came up with the following: “We believe that rising bank interest rates and increasing energy costs will increase the cost of our IT infrastructure by 35% by 2025, therefore we are accelerating our move towards putting our software into a public cloud hosted by Amazon, which we also believe will reassure our customers and enable us to grow faster in the US market.”

Go deeper, ask what key challenges you face in the industry, what you can do about them, and what might happen in the future? Then test the logic of your assumptions.

In Peter’s case, they concluded: “We believe that the regulatory environment will become more stringent on our customers, meaning they will seek to outsource key elements of their business, as they no longer can afford keeping large regulatory teams. We are going to create a new specialist regulatory team, with the intent of thought leadership in our industry and with our customers.”

External Diagnosis Map Review: Find the Opportunity in Crisis

Revisit this External Diagnosis Map with your team every quarter and adjust it to keep pace with the rapidly changing external environment. Debate the implications of each change on your internal company processes and update your strategy accordingly. The External Diagnosis Map Reviews allow you to gage the current temperature and forecast what’s coming over the horizon so that you don’t get caught out by unexpected storms and turbulence. While your competitors are deluged and thrown off course, you are piloting the way through. Instead of assigning blame to secondary causes, you are targeting attention and resource where they are needed. This competitive advantage is your opportunity in a crisis.